Complete payment recovery services play a critical role in the financial health of businesses. They offer structured methods to manage overdue payments, which can significantly impact cash flow. By implementing effective strategies, companies can streamline their recovery processes while nurturing client relationships. However, the balance between assertiveness in recovery and maintaining goodwill is delicate. Understanding how to navigate this landscape is essential for long-term success and stability. What strategies can truly enhance this balance?

Understanding Payment Recovery Services

Although many businesses encounter challenges with overdue payments, understanding payment recovery services can provide a strategic solution to this prevalent issue.

These services offer numerous benefits, including optimized cash flow and reduced financial stress. By leveraging professional expertise, companies can reclaim lost revenues effectively while maintaining valuable client relationships.

Ultimately, payment recovery services empower businesses to regain control over their finances, promoting long-term financial freedom.

Effective Strategies for Recovering Unpaid Invoices

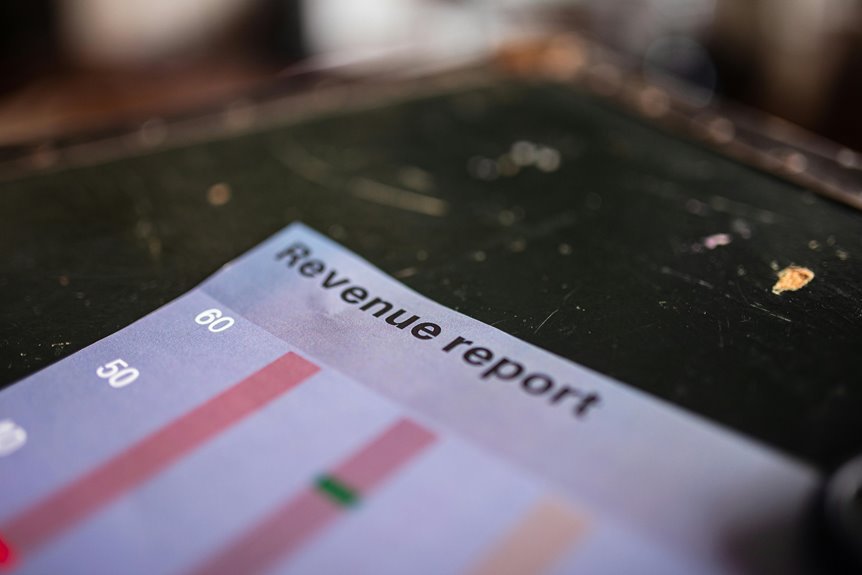

Implementing effective strategies for recovering unpaid invoices is crucial for maintaining a healthy cash flow and ensuring business sustainability.

Companies should utilize automated invoice reminders to prompt timely payments and consider offering flexible payment plans to accommodate clients’ financial situations.

These approaches not only enhance recovery rates but also foster goodwill, ultimately contributing to a more resilient and thriving business environment.

Maintaining Client Relationships During the Recovery Process

When navigating the often delicate terrain of payment recovery, companies must prioritize maintaining client relationships to ensure long-term business success.

Effective client communication is essential; it fosters transparency and trust. By employing strategic relationship management techniques, businesses can mitigate tension, ultimately preserving valuable partnerships.

This approach not only aids in recovery efforts but also empowers clients, reinforcing a commitment to mutual success and collaboration.

Conclusion

In conclusion, Complete Payment Recovery Services serve as a crucial cornerstone for cultivating cash flow and client connections. By adopting adaptable approaches and prioritizing transparent communication, businesses can deftly navigate the delicate dynamics of debt recovery. This strategic synergy not only safeguards financial stability but also strengthens client loyalty, fostering a foundation for future growth. Ultimately, embracing effective recovery practices empowers companies to transform challenges into opportunities, ensuring a sustainable path towards prosperity and progress.