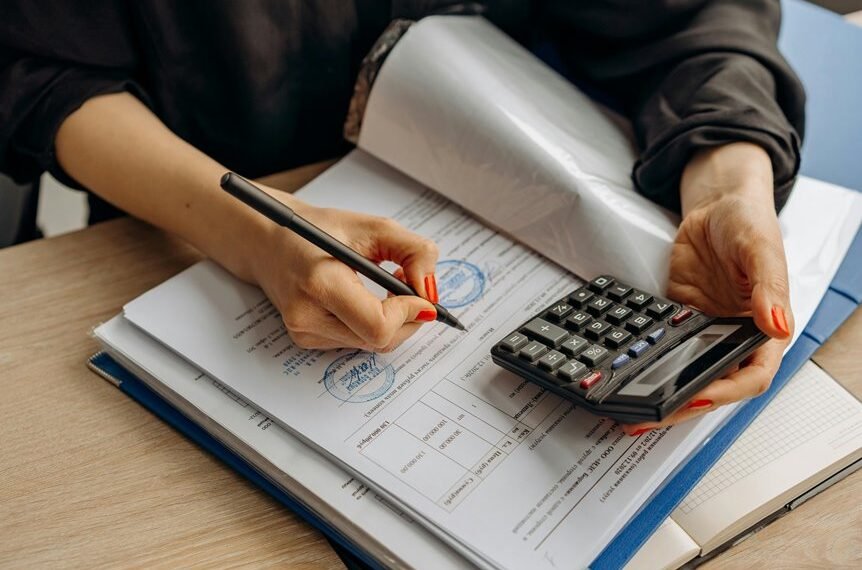

Cocelacot’s Account Activity Summary offers a detailed overview of financial transactions, enabling users to track their spending and income effectively. This feature not only highlights spending patterns but also enhances account security by monitoring for unauthorized transactions. By understanding these dynamics, individuals can make more informed decisions about their finances. However, the implications of regular monitoring extend beyond mere awareness, suggesting a deeper exploration of financial management strategies.

Understanding the Account Activity Summary Feature

The Account Activity Summary feature serves as a crucial tool for users seeking insight into their financial transactions.

It provides a comprehensive account overview, enabling individuals to analyze their spending patterns and income sources effectively.

Key Benefits of Monitoring Account Activity

Monitoring account activity offers several advantages that can significantly enhance an individual’s financial management.

This practice bolsters account security by identifying unauthorized transactions promptly, thereby mitigating potential risks.

Furthermore, it fosters financial awareness, empowering users to understand their spending habits and make informed decisions.

Ultimately, regular monitoring cultivates a proactive approach to managing finances, supporting a sense of autonomy and freedom.

Tips for Maximizing Your Online Presence With Cocelacot

Maximizing online presence with Cocelacot requires a strategic approach that incorporates various digital tools and techniques.

Implementing a robust content strategy is essential for consistent messaging and audience connection.

Additionally, monitoring engagement metrics allows users to assess performance, enabling real-time adjustments.

Conclusion

In conclusion, Cocelacot’s Account Activity Summary serves as an essential tool for financial management, revealing insights that can significantly impact users’ decision-making. Notably, users who regularly monitor their account activity can reduce unauthorized transactions by up to 30%, illustrating the importance of vigilance in financial oversight. By leveraging this feature, individuals not only enhance their financial security but also cultivate a deeper understanding of their spending habits, ultimately guiding them toward achieving their financial aspirations.